With the recent new legislation and emergence of Opportunity Zones, the NEXUS Working Group on Impact Investing is at the forefront of the discussion. From deciphering the laws to understand the true impact potential of Opportunity Zones, the Impact Investing Working Group will be offering programming, delegations and thought leadership on the subject to better inform and support are members as they consider the financial and impact merits of this new real estate investment.

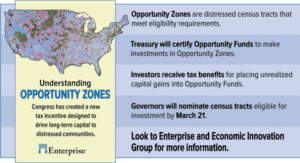

Context: Opportunity Zones are a community development incentive program born out of Congress in the Tax Cuts and Jobs Act of 2017. The goal is to stimulate long-term investments in distress economies (areas of cities appointed by Mayors and Governors) with the benefit of capital gains savings to the investor.

Key Takeaways from the Nexus Opportunity Zone Dinners at the March 2019 USA Summit:

– Limited philanthropic engagement to-date (particularly, local community-based philanthropy)

– The vast majority of deals have been real estate focused

– The deal flow has historically started with the asset class and ended with the impact rather than the other way around

Our Response: The Nexus Working Group on Impact Investing is setting up an education platform that will enable Qualified Purchasers (and philanthropic partners) to deploy capital to Opportunity Zones with a focus on starting with the impact and then working toward the deal structures across asset classes. We’ll be using a 3D approach to capital deployment leveraging our connections across the financial and philanthropic community and intellectual rigor across the community.

Get Smart: Nexus members will have the opportunity to learn about deal fundamentals, drivers and valuations across Real Estate, Community Development, and Venture Capital. Moreover, at each site, you’ll receive briefings from government representatives, nonprofit executives, CDFIs, and academics who are familiar with the sites we’re visiting.

Visits: Site visits will range from 1-2 days. We currently have conversations active in Dayton, OH, Baltimore, MD, Newark, NJ, and Philadelphia, PA. For those interested, we can also access additional opportunities on the West Coast.

Capital Deployment Requirements: If you participate in this track, you’ll be expected to deploy a minimum $25,000. Our cumulative deployment will be in 7-figures.

Please let us know if you’re interested in participating in this program.

Recent Comments